In honor of the Academy Awards, I thought it would be fun, to host celebrity week here at Gen Y Wealth. During this week, I will be giving you my opinion on financial celebrities Dave Ramsey , Suze Orman, and Robert Kiyosaki. Monday, I gave my thoughts on Dave Ramsey. Let’s continue today with Suze Orman.

In honor of the Academy Awards, I thought it would be fun, to host celebrity week here at Gen Y Wealth. During this week, I will be giving you my opinion on financial celebrities Dave Ramsey , Suze Orman, and Robert Kiyosaki. Monday, I gave my thoughts on Dave Ramsey. Let’s continue today with Suze Orman.

Introduction to Suze Orman

You might recognize Orman’s name from her show, The Suze Orman Show on CNBC, her appearances on Oprah, her six consecutive New York Times best sellers, or her PBS specials, etc, etc, etc…

It’s getting a little hard to even avoid her. She was even selected as one of Time Magazines 100 most influential people in the world.

If you’re dying to know more, check out her Wikipedia page.

So how is her financial advice? Let’s dig in and find out….

The Good

Explains The Basics

Suze’s basic message is advice you would receive from your grandma. Spend less then you earn, don’t go into debt, and develop good financial habits….

She preaches these basics constantly in her writing and speaking.

Books

The only book I have read of Suze’s is The Money Book for the Young, Fabulous, and Broke. This is an excellent read for anyone in Gen Y. Until, I Will Teach You To Be Rich, came out, this was the one, must read financial book for the twenty something age group.

On Your Own for Retirement

Suze constantly lets people know that it is up to them individually to save for retirement. It’s not the Governments job, nor is it your employers. How and when you choose retire is entirely up to the individual. I couldn’t agree more.

Certified Financial Planner®

Unlike many media personalities, Suze has the credentials of a certified financial planner®. Which I found last year, takes a lot of work to pass.

The Bad

Emergency Fund Over Debt Repayment

Suze used to say that you should develop a small emergency fund, say around $1,000, and then get right to paying off debt.

Recently, she switched too saying, “If you have an unpaid credit card balance not much saved up in emergency savings, I need you to listen up. My advice has changed. I want you to only pay the minimum due on your credit card balance, and instead, make it your top priority to build as much of an emergency cash fund as you can.”

I just can’t agree with the above statement. It can take one or two years to develop a fully funded emergency fund. That is too many months to let high interest credit card debt accumulate.

Encourages Home as an Investment

Suze herself has built considerable wealth in the real estate market. She recommends buying a home early, even before maxing out an employer match on a 401K.

My opinion, a home isn’t an investment. It’s a place to live that costs you a lot of money. The price can go up and the price can go down. It shouldn’t be counted on as a retirement asset. Plus, your employer match is the highest returning investment you will ever make.

Individual Bond vs. Bond Funds

Suze discourages the use of bond funds. There is a long debate on the advantages and disadvantages of individual bonds vs. bond funds, but this isn’t why I don’t like this advice.

The reason I don’t agree with individual bonds is because individual bonds are not available in 401k”s. This makes this advice worthless for the average investor who invests primarily in their 401K.

Dislike of Target Retirement Funds

Suze had this to say about Target Retirement Funds, “Give me a break! You should invest in bonds only when interest rates are going down.”

Since most target retirement funds contain bond funds, an allocation that Suze dislikes, she doesn’t recommend the use of target retirement funds.

This statement is wrong in so many ways. First, we don’t know where interest rates are going. Therefore, if you wanted to invest in bonds according to Suze, you would try to time the market. Very dangerous advice.

Second, not everyone has the same risk tolerance. Some people prefer to sleep better, compared to eating better.

The Ugly

A Flip Flopper

Suze has changed the core of her message a few times. The emergency fund and debt issue, pales in comparison to her switching from active to passive managed mutual funds.

In 2008, Suze had this to say when asked about index funds, “I’m switching for the first time in my life. All the stats say that index funds outperform 80% of managed funds out there. And a few years ago I’d have said just buy Vanguard’s S&P 500 index fund (VFINX) or its Total Stock Market index fund (VTSMX).

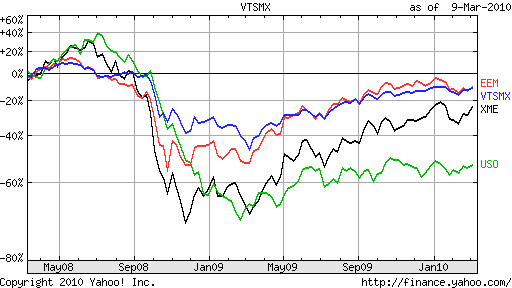

But today I think you have to be more active, and I like exchange-traded funds that let you own particular sectors, like iShares MSCI Emerging Markets (EEM), United States Oil Fund (USO) or the Metals & Mining SPDR (XME).”

When you’re giving advice to millions of people and tell them to avoid buying a mutual fund that will perform in the top 20% of all mutual funds over the next 10 years, you’re doing them a disservice.

Here’s how dangerous active investing can be for the average investor. This chart shows the comparison between the Vanguard’s Total Stock Market Index, MSCI Emerging Markets, United States Oil Fund, and the Metals and Mining SPDR over the past 2 years.

As you can see, the Emerging Markets and the Total Stock market are down around 10%. The Metals and Mining SPDR ETF is down around 25%. Last, the United States Oil Fund is down around 55%. Active investing can be dangerous for individual investors.

Conclusion

Suze core message is great. Stay out of debt, spend less then you earn, etc…

Just don’t follow her investing advice.

{ 5 comments }

I also believe Suze gets paid to preach FICO

You bring up a good point. A lot of these financial celebrities get paid, a lot of money, to pitch others products. Just like the rest of us, they each want to grow their business each year.

I actually agree with her on the emergency fund, but where we would differ is that I wouldn’t have changed my opinion on it. If I wrote about that sort of thing, I’d preach it from the start. Liquidity and preparedness can help you save all kinds of money on things like water damage from a broken water heater to insurance with higher deductibles. That flexibility moves to other areas of your life too like employment. That’s just my take.

The problem I see with her investment advice is she doesn’t say what type of investment strategy it is and doesn’t talk about developing your own and sticking to it. Is it sector rotation, value, buy and hold? When people have tools but don’t know how to use it is when they are wreckless – like using a hammer to tighten a dripping faucet.

It’s amazing to think how many lives were affected when a “financial celebrity” changes their opinion on a particular topic.

I will never forget an article I read by Jason Zweig, who is one of my favorite financial columnists, explaining the inflows to a mutual fund after he recommended the fund. He didn’t realize how big of an impact he actually had.

Unfortunately people tend to act very quickly when they are following someone they trust.

I am not a big fan of Suze. She at least brings much needed attention to personal finance, I just wish her methods and advice were better. Plus, her voice is like fingernails on the inside of my skull.

I do own bonds via the BND and TIP ETF funds. But I do not plan on adding to them until interest rates are a couple points higher and then more new money will go to bonds to catch up to their allocation. Suze is right in that buying bonds is wise to do while rates are falling. As you say, in normal times you really can not predict what interest rates will do but in the current environment, there is really only room to go up.

Comments on this entry are closed.