Who is Dave Ramsey? Dave Ramsey is a radio host, author, television personality, and motivational speaker.

His radio show is broadcasted on over 450 stations throughout the U.S. His TV show, “The Dave Ramsey Show” is weekdays on the Fox Business Network.

He has authored a few books, including a favorite of mine, The Total Money Makeover.

For more on his background, you can visit his Wikipedia page.

Is Dave Ramsey a scam? Lets dig into his teachings to find the good, the bad, and the ugly.

The Good

Dave Ramsey’s Baby Steps

Ramsey’s teaching are centered around what he calls “The Seven Baby Steps“. The 7 steps are:

- Build a $1,000 emergency fund

- Pay of all non-mortgage debt

- Build a full emergency fund

- Save 15% into tax-advantaged accounts

- College funding for children

- Pay off home

- Build wealth and give

I happen to like the Ramsey’s baby steps. They give an easy to follow plan for a majority of his followers. While it might not be the best plan for everyone, you’re not going to get yourself into a lot of financial trouble if you follow the steps.

Motivation

Ramsey has helped more people get out of debt than anyone in the U.S. One factor that has led him to become so popular is that he is very motivating. Listen to Ramsey’s podcast or read The Total Money Makeover and you will feel empowered to start taking action.

Hates Any Type of Debt

Any advice from Ramsey will never end with going into debt. He even advises you to stop using credit cards, in favor of debit cards, even if you have always paid off the balance in full at the end of the month.

Ramsey is also a big fan of paying in full for a house or going with a 15 year mortgage.

The Bad

Concrete Rules

While I love the baby steps, they shouldn’t be as concrete as they are. I understand that he is giving advice to so many people in so many situations, that it’s hard to talk about all possible scenarios that can arise. However, from what I can tell, Ramsey is very adamant about everyone following his baby steps.

For example, should you contribute to a retirement fund with an employer match or should you pay off your student loans? According to Ramsey, you should always pay off your student loans.

From my perspective, you need to dig deeper into your personal situation before you commit. Let’s say you had $20,000 in student loans at 4% interest and an employer that matches 50% up to first 6% of your contributions to their 401K.

That is a large opportunity cost if you choose to forgo 401K contributions until you pay off all your debt. If you have displayed responsibility with managing money in the past, there is no reason to suffer that opportunity cost.

Should Everyone Stop Using Credit Cards?

This is another gray area, where I don’t think there is one answer.

Personally, I get many benefits from my credit card company. Just last year, I got about $2,000 back from Chase, for an unfulfilled contract with my wedding photographer. If I paid with cash, check, or debt card, there is no way I get this money back.

I’m taking an upcoming trip, in which I fly for free to thanks to my American Express Starwood Rewards Card.

12% Rate of Return

Ramsey advises that if you put your retirement savings into growth stock mutual funds, you can earn 12% rate of return a year.

According to Morningstar there are 704 total U.S. large-cap growth mutual funds (growth is his most preferred asset allocation) available today.

Over the past 10 years, here are the top 5 performing funds in that category and their ten year annualized returns:

- CGM Focus = 19.11%

- Century Share Institutional -= 7.96%

- Calamos Growth & Income A = 4.41%

- Prudential Jenneson 20/20 Focus A = 4.39%

- CGM Mutual = 4.27%

The category average over the past 10 years was negative 2.63%.

The category average for international large-cap growth stock mutual funds, another one of Ramsey’s asset allocation recommendations, was a little better at 2.37%.

As you can see, it’s dangerous to assume that you can get 12% rate of return a year. This can cause you to significantly underfund your retirement portfolio.

8% Withdrawal Rate

Worse than the 12% expected rate of return, Ramsey advises that you can then withdrawal 8% of your portfolio for spending each year during retirement.

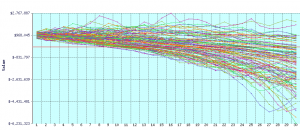

Luckily we can use a calculator like Firecalc to see what the success rate will be. For this example, I’m going to assume you have 30 years in retirement, have a $1,000,000 portfolio all in the S&P 500, and spend $80,000 each year, adjusted each year for inflation at 3%.

Here are the results from Firecalc…

The success rate that you will be able to maintain this withdrawal rate based upon the history of the stock market is, 16.5%. In other words you have an 83.5% chance of failure.

The advice that you can count on 12% return and an 8% withdrawal rate, is extremely dangerous.

Asset Allocation

Moving on with his investment advice, Ramsey advises for you to allocate your assets into:

- 25% Growth Stock Mutual Fund

- 25% Growth & Income Stock Mutual Fund

- 25% Aggressive Growth Stock Mutual Fund

- 25% International Stock Mutual Fund

While this portfolio could be considered to be diversified among stocks, it’s lacking in asset allocation among other classes such as bonds, TIPS, and REITS.

This is a lot of risk to take on for someone who is close to retirement, in retirement, or even someone in Gen Y who has a low risk tolerance.

The Ugly

Loaded Funds & ELP’s

Dave explains, on his investment philosophy page, how he pays 5-6% every time he buys into a mutual fund. Instead of investing by himself and paying no fees, he chooses to “go with a pro.”

One area where his business makes money is by endorsing local providers. You can go to his website and search your zip code and get a list of investment, real estate, insurance, and tax advisers that he recommends. These advisers pay Ramsey to be listed as an ELP. In return, advisers get referrals from Ramsey’s, who happen to think paying a 5-6% up front load is OK.

I have searched his site for an example showing how a typical portfolio would do paying 5% to invest, assuming a return of 12%, and withdrawing 8%. Unfortunately, I can’t find this evidence he continues to mention.

Is Dave Ramsey a Scam?

Is Dave Ramsey a fraud or a scam? In short, no

Dave Ramsey is great a getting you out of debt and interested in finance. If you need some motivation to get started, download his podcast or read his book.

Just be careful to follow all of his advice, especially investment. I see a conflict of interest between his endorsement of ELP’s and your best interests as an investor.

What are your thoughts on Ramsey? Do you agree or disagree with my opinions of him? Have you followed his investment advice? Let me know in the comments…

{ 15 comments }

I would agree that he has so many followers that is easier to stick to concrete rules. Yeah, some of the rules can be modified a bit and if you listen to his radio show often enough you will see example of him recommending different paths for different situations. But really, I would guess that his plan is a great jumping point for 99% of the American population. If everyone in this country were to follow his plan we would surely be in a much better place.

I also like to use my credit card and get the rewards. With my budget tool it really doesn’t look any different on [digital] paper. I still live debt free and only spend what I have in the bank.

.-= Dustin @ Envelope Budget Software´s last blog ..Kind Words from Inzolo Members =-.

@Dustin

Thanks for the comment. I agree. We could all learn a thing or two from Dave Ramsey. He preaches common sense, which I love.

Even though I am an avid Ramsey podcast listener I have not yet “drunk the cool aid.” I agree that his advice is very simplistic and I don’t agree that NO debt is the best way to go. Donald Trump didn’t get rich paying cash for all that real estate – it’s called leverage.

However, I think the vast majority of people cannot handle debt responsibly. I would even put myself in that category sometimes.

As for your college loan vs. contribution example Ramsey would say that you are using math. And that your problem is not a math problem but a behavior problem. In other word most Americans have never learned how to handle money so he doesn’t trust anyone to do it right in the future.

As for the CCs he would say that studies prove that you will spend more money with a CC than with cash. McDonalds commissioned a study before they started taking credit cards and found that the average sale increased by 14% (don’t quote me on that – it may be higher) It’s just easier to spend if it’s not real money.

All in all I listen to Ramsey more for motivation/entertainment than real hardcore financial advice. It’s a good may to kill time in the car.

@Neil – Thanks for the comment.

Haha. I listen to his podcast occasionally too, mostly for entertainment.

I see your point on leverage. However, most people don’t know how to use leverage to their advantage. It usually ends up hurting them in the long run.

Never heard of that CC study before. Need to check that one out. I do believe it though. However, your best bet is to just not eat at McDonalds all together.

I have read Dave Ramsey’s books, and I agree that his baby steps are easy to follow for most people. His baby step approach is probably one of the reasons he has been so successful. They are concrete, and don’t apply to every situation, but I think that they are general enough that most people can do them easily. Plus I think a lot of people really do need simple concrete rules.

His advice on credit cards is one of the things a lot of people disagree with him about. But it is true, from many sources, that people tend to spend more on credit cards than when they pay cash. So, by not paying with credit most people do save money. That is not his only reason. The recent credit card laws that have passed, have shown how dishonest dealing with these companies can be, I certianly don’t want to deal with these banks and play games that are very hard to win. Another reason he suggests giving up credit cards (an probably the largest reason) is his methods are about behavior modification. Most people who have large amounts of credit card debt have proven they cannot be responsible with credit cards. It would be best to take the temptation out of their lives.

As for the 12% return, even most Dave Ramsey fans will tell you they don’t agree with that. I use 8% based on the stock market average, and will continue to do so. The living off of 8% comes from the 12% return, so that is really one point in the “bad.” He says that if you amek 12% on your money, and inflation steals 4%, then you live off the other 8%. Inflation has averaged around around 4.1% over the past 50 years, so 4% is a good marker. He says live off of 8% based on a 12% return, if you use an 8% return in your calculations then you need to be able to live off of 4% of your investments.

In his other book, FInicial Pease University (which is also a video seminar consiting of 12 lessons) he does go further into detail of why he chooses these investment types. He does prefer mutual funds, advises against single stock and bonds, REITS, etc. His advice is single stocks are too risky, bonds go up and down just as much as stocks do, but with lower rates of return, so not really any safer. REITS do not perform as well as mutual funds and have heavy fees built in. He does say that if you really want to invest in them, no more than 10% of your income.

For the ELP, and the 5-6% fees. He says on his website that he choose A share mutual funds, with a 5-6% upfront fee. The 5-6% is not an annual fee, he actually advises against those, because as your account grows the fees grow as well. If you are planning long term investing, paying 5% up front is much cheaper in the long run than paying 1-2% a year for the next 10 years. And while he does consider himself a pro, he is the first to say that you want to get other opinions. Don’t let them make the decisions, but get opinions from others. Two heads are better than one type of thing.

I actually took a Dave Ramsey course one time. I think it was either 8 or 12 weeks long, I can’t really remember.

I have to say that everything I learned was very touching. After the first class I immediately went home and cut up my credit cards and then I began to devour the book.

I can’t say that I’m still using his methods, but my parents still are and there getting more and more out of debt every month thanks to the “snowball effect”.

.-= Scott@Forex Robot´s last blog ..Compare Forex Trading Software =-.

Good article. I like his advice on debt and he is spot on when he says that things look/feel different when you are debt free. We are (house and all) and we look at things a bit differently. We weren’t followers of his per se but enjoyed some of the advice.

His investment advice borders on ill-informed to catastrophically bad. . here are a few examples:

1. Full investment in the stock market regardless of your age. I am sure there many retirees who are sorry they followed this advice. I can remember listening in 2007/8 and he advised a call to take her pension in a lump sum (around 500K) and invest it ALL into the stock market so she could “make 12%”. Wow, If she followed his advice she is down over half counting her withdrawals to live on.

2. 12% – yeah, has been beaten around here, but still true. This is a totally unrealistic number to use but many newbies hear it and believe it and make very bad decisions because of it. Peter Lynch who ran Magellan during its great run (15% percent a year for almost a decade) wrote in his book that the average Magellan investor still only made 7% or so because of timing, withdrawals, taxes, etc.

3. Prepaid tuition is bad. No, it isn’t. He will say that tuition increases have averaged 7% a year but you can get 12% a year in the market (no you can’t). He doesn’t factor in ANY risk, like the 12% is guaranteed. Well, if you followed his advice in the last 10 years with your kid’s tuition you are at best even, at worst down 40%.

4. Real estate is a “great investment”. No, it isn’t. He is a real estate fanboy and touts his real estate ELPs . . .real estate has appreciated at about the same as the rate of inflation for the last hundred years and he must know this, but continues to push how great an investment it is. . well, many in the US (can you say FL, CA, AZ, NV, MI) would greatly disagree.

So, net/net, he is a salesman. Don’t forget that. This doesn’t make him a bad guy at all (I am in sales) but you must keep this in mind. He is selling a system that has many great aspects (get out of debt, all debt asap) and many bad aspects (his investment advice, love of real estate, etc). He is in this business to make money – again, nothing wrong with that at all. People make the mistake of thinking he is in “ministry” – people will call all the time and thank him for his “ministry”. He does not have a ministry, he has a private business and wants to sell things (most of which are good for you). He makes no details of his business public including charity or philanthropy. He talks as though he gives a great deal of money away and how it is important to do it but never provides any proof of it.

So, IMO, take his advice on debt, disregard his advice on real estate, and temper his advice on investing.

I wonder if Fox News letting Dave Ramsey go for Eric Bolling will affect his popularity?

I just met with a Ramsey-referred ELP in my area. I’m on step #6 & #7. I’m looking to maximize my investments. I have a variety of 401K, IRA, and personal savings and no debt outside of my mortgage. I came with all of my financial information laid out and now I’m regretting it.

This ELP brought out a folder of American Fund investments and that’s the only thing he advised in terms of ‘financial planning’ (i.e. purchase some of these mutual funds that he is peddling for sales fees that he earns upfront).

I was disappointed and surprised Dave would go this route as opposed to fee-based CFP or CPAs, who do not make commissions by suggesting the investments they peddle, which obviously has a bias built in.

I’m going to instead see a fee-only CFP who doesn’t sell any securities, and get an updated investment strategy. Buying mutuals at a a sales load of 5.75% isn’t a plan for anyone but the ELP to make some commissions and Ramsey for getting his share from the ELP.

No thanks, Dave. Your investment advice sucks. Never, ever put your financial future in the hands of someone who makes a living selling you very specific investment products.

@Nan – Great decision to start seeing a fee-only CFP. Start your search with NAFPA or Garrett financial planners. Both are trusted. Plus, don’t be afraid to meet with multiple CFP’s before you decide who to place your business with. Good luck!

One thing people have to keep in mind when using the information that Dave teaches is the he is preparing people to live a “DEBT FREE” life. For those who want to get the points/rewards on credit cards or want to invest in their 401(k), you can expect that their perspective on his teachings will clash. His advice is not for those who believe in using other people’s money to get rich or for those who have a desire to improve thier FICO score.

I have applied Dave Ramsey’s principles for 3 years now and will continue to do so. In the past 3 years I have paid off $65K on all credit cards and my car. Now I am paying down $54K in student loans. My company matches 5.5% in 401K, but I don’t know what that looks like over the course of a year. Maybe one day I will do the math, but my goal is to live a debt free life.

When I get to the investment step I will consult an ELP, but if the ELP is not well versed in the principles and persepctive that Dave has I will consider going somewhere else. It would be more important for me to go to someone is is familiar with the perspective then someone who has been endorsed.

@Broke,

First of all, congrats on getting out of debt. Second of all, I like your goal focused mentality.

Last, you bring up a great point. No matter if a financial adviser is a ELP or not, it’s always good to get a second opinion. You should try going to one ELP and one fee only CFP. It will be good to get both perspectives.

I’ve thrived off listening to Dave Ramsey’s advice and thanks to him, he’s inspired my wife and I to get almost completely out of debt – we have a little bit left to go.

I agree with his principles plus where and how he’s getting coming to his conclusions, but I’m not on board for his total anti-credit card stance. Credit cards are neither morally wrong nor stupid – sadly, people are.

As someone living in Australia we’ve found that we have to modify Dave’s baby steps because of some local factors. For example, the cost of living is so much higher here than many of the callers to Dave Ramsey show. And, the cost of owning a home is enormous compared to the US – house prices went up during the GFC instead of crashing.

One way that I like to think of it is Ramsey gets people from poor/lower class into a more solid middle class. Once you get through the debt, you do need to use a different guide to become rich.

I think that he does a lot more good getting the lower end lifted than harm from keeping the middle down.

Hi ya RJ, I am interested in this also. (Take a look at my latest article for details.) Your article was a really great read; you have certainly provided me with lots of food for thought.

Many thanks 8-P,

cars2scrap

Comments on this entry are closed.