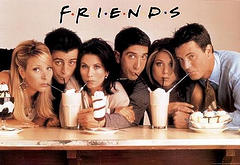

How did Jennifer Aniston get the honor of having an imaginary Hall of Fame named after her? Well back when she was married to Brad Pitt, she willingly agreed to let Brad do a movie with Angelina Jolie. To no one’s surprise, Brad is now with Angelina.

How did Jennifer Aniston get the honor of having an imaginary Hall of Fame named after her? Well back when she was married to Brad Pitt, she willingly agreed to let Brad do a movie with Angelina Jolie. To no one’s surprise, Brad is now with Angelina.

What I’m trying to say is, how in the world did Jennifer Aniston not see that coming? For the guys out there, that’s like letting your wife/girlfriend hang out with Charlie Sheen (aka Rick Vaughn) or Ben Roethlisberger and being surprised they made a move on her.

So in Jen’s honor, I only think it’s fair that I name the Hall of Fame of Financial Mistakes that Everyone Saw Coming after her (I’m sorry mom. I know how much you love her).

Here are the 6 Inductees:

(For those who don’t enjoy my humor, just consider this post 6 financial moves that always end up in disaster.)

# 1 – Just a Little Credit Card Debt, it’s Only One Time, and it Will Never Happen Again

Stop thinking about money for a second and think about how people gain weight.

They gain ten pounds over the holidays. Followed by loosing six in January.

Next December rolls around and they again are a little lazy in their eating habits, which causes them to gain another ten pounds. It’s just some winter weight, right? They make the same resolution as last year and again manage to loose only 6 pounds. Now they are 8 pounds over what they were two years ago.

Over one or two years, it doesn’t make much of a difference. However, ten years go by and all of a sudden this person has gained 40 pounds.

This is exactly how people get into credit card debt.

It starts out with just a small balance one month and a promise to yourself that it will be a one time thing. However, for whatever reason it’s still there the next month. A few more months go by and you’re having trouble just making the interest payments.

The easy way to avoid this is at all costs, never carry a balance on your credit card. It sounds simple but it works.

# 2 – Loaning Money to Friends and Family

I have yet to hear of a situation where loaning money to family or friends works out. Even if you get paid back, there’s alaways bad feelings towards the borrower.

You might trust and love this person but if they’re borrowing money from you, they haven’t managed their finances well in the past. Unfortunately,there is a good chance this behavior will continue in the future.

# 3 – Buying a House with Little Money Down

Say you buy a house for $250,000 with 4% down.

The first problem is that your mortgage payments are primarily going towards paying off the interest and not the principal. Therefore, you have to live in this house a long time before seeing any appreciation after paying closing costs.

The second problem occurs if the house goes down in value, which is very likely.A 10% decline over a two year period, means the house is now worth $225,000 and the amount you owe is around $239,000.

The third problem is when you have to move (job relocation, family, etc) and you owe $14,000 . Plus, you need to add in real estate commissions and closing costs. Now you’re in the hole $25,000.

# 4 – Complicated Life Insurance

If you don’t understand what you’re buying, then you shouldn’t be buying it. This is a good rule for your money in general, but especially in regards to life insurance.

Term life insurance is simple and useful. There’s a small chance your situation might call for something more, if it does, make sure you understand what you’re buying.

If you need an outside opinion, pay a fee only certified financial planner to review your life insurance. You might spend anywhere between $150-250 for an hour review. That’s money well spent.

# 5 – Buying a Nice Car Because You Can Make the Payments

I’ve seen it happen over and over again where someone who just gets their first job buys a new car. The monthly payment isn’t difficult to afford now because their expenses are low. Typically, they are living with a roommate or at home with their parents.

The problem is, they haven’t saved a penny. So they can afford the payments now, but not after maxing out their 401(k) employer match. Or, they haven’t looked at other big expenses they have coming up in the next five years, such as an engagement ring, wedding, a down payment for a house, and a Roth IRA.

So yes, they might be able to make a payment on the car. However, they do so at the expense of more important goals.

# 6 – Timing the Market, Day Trading, & Trading Foreign Currency

It doesn’t work. Around 90% of people fail miserably. A few more are lucky enough to get their money back. The ones who make the money are the ones selling the products and software on infomercials.

###

If you know of any other financial moves that always end in disaster, please share them in the comments.

Photo by: Hot Rod Homepage

{ 9 comments… read them below or add one }

Your description of putting on weight at the holidays compared to just a little credit card debt is good. I just got my first credit card 3 or 4 months ago because a hotel declined my debit card on a 3 night business trip; EMBARRASSING. But there are worse things in life, like not being able to weild the power of compound interest beause a person is climbing out of “oh…it’s just a one time thing going into credit card debt.” It has been interesting to me that for 28 years I’ve not had a credit card and been good to go, now that I have one, it is so easy for me to push my budget just a little past it’s ability. What scared me straight is now having to push back starting a Scotttrade account and Roth because of a small credit card debt looming.

“You might trust and love this person but if they’re borrowing money from you, they haven’t managed their finances well in the past. Unfortunately,there is a good chance this behavior will continue in the future.”

hmmmmm……………

Just because someone needs to borrow money it doesn’t mean that they haven’t managed their finances well in the past. People borrow money by using their credit card, but if they pay it back monthly when they get paid, does that mean they’re bad with their money? I have borrowed money from family before, but they charged me 6%! Yes my family is a bunch of scammers….they loved loaning to me because they knew I would be able to pay them back but they were earning 6% interest while rates have been so low!!

@Kathryn – If you’re in a situation where you have to borrow money from your credit card and have to wait to pay it back until you’re paid, I would argue that you haven’t managed your finances well in the past. The goal isn’t to be in a situation where you have to wait until your paycheck arrives to pay your credit card bill.

Also, when it comes to borrowing money, as I said there usually some bitter feelings involved even if the money is paid back. Which in your case, sounds true.

@RJ wasn’t talking about myself…was just making the point that people usually people get paid 2x per month and your credit card bill comes 1x per month, so paying your credit card bill off 1x per month is fine. Credit cards are used for convenience, not for extending yourself beyond your financial limits so just because someone pays off their credit card bill at the end of every month, it doesn’t mean that they have managed their finances poorly.

I was kidding about my family being scammers, I think that parents *should* charge their kids interest if they need to borrow. I feel lucky that they have even lent me money when I needed it.

Lastly, it’s not even possible to get a mortage with 4% down. That’s so 2006!

@Kathryn C and @RJ I’ve really enjoyed this conversation! I am two semesters into my MBA which my folks are financing at 0%. I bought a house 6 months ago at 4.0% (both of those facts simply to add to the conversation). I chuckled when you called your family a bunch of scammers, at least you know where you stand though Kathryn C. I have close ones to me who save money by allowing me to pick up the majority of the bills. I am not sure if it is beacuse they think I don’t notice, or if it is because they expect it or what…Anyway, it gives me the chance to practice being humble , and from reading “The Millionaire Next Door” I think MNDs are humble, both of which I would like to become.

Good article. I appreciated your point about purchasing a home with little down. While it may not be as easy today as it was a few years ago, people are still purchasing homes without enough down. I would suggest at least 20% down, but my wife and I are shooting for more than that when it comes time for us to purchase our home. The less debt I can take on when buying a house, the better.

Also, while I would never do it again, I did borrow money from my parents. They offered (unsolicited) to loan me a large amount so that I could pay off my high interest (6.8%) student loans, and then pay them back at 1%. I was able to pay them back within a year, and there are no hard feelings on either side. The reason I would never do it again, I simply don’t like owing family money. It worked out well, both sides benefited, but there is something about owing my parents money that I simply do not like.

@Kathryn C – Sorry. I misinterpreted what you were saying. I figured that you meant that people have no other choice but to wait until their paycheck comes in, to pay their bill. Therefore, they would have no other cash set aside, such as an emergency fund.

[...] The 6 Honorary Inductees to the Jenifer Aniston Hall of Fame of Financial Mistakes that Everyone Else Saw Coming (or 7 Financial Moves That Always End up in Disaster) [...]

I like reading an article with a touch of humor.I am so scared with this 6 inductees,glad never abduct by one of them.Lol Thank you so much for this great read aside from it’s funny i find it very useful especially in managing finances.Wishing you all the best in life and good luck!