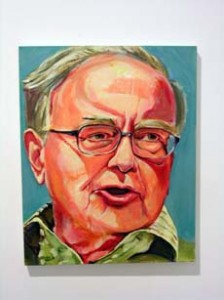

Warren Buffett has never written a book. That’s not to say his wisdom hasn’t been put on paper.

Warren Buffett has never written a book. That’s not to say his wisdom hasn’t been put on paper.

Each year, Buffett writes a letter to the shareholders of Berkshire Hathaway. Each letter, dating back to 1977 is available on the Berkshire Hathaway website for free.

Reading through the archives is like getting your MBA in a few hours. Buffett’s way of explaining difficult concepts with ease and humor make each letter very enjoyable.

One of my favorite letters he has written was in 1997. In it Buffett writes:

“A short quiz: If you plan to eat hamburgers throughout your life and are not a cattle producer, should you wish for higher or lower prices for beef? Likewise, if you are going to buy a car from time to time but are not an auto manufacturer, should you prefer higher or lower car prices? These questions, of course, answer themselves.

But now for the final exam: If you expect to be a net saver during the next five years, should you hope for a higher or lower stock market during that period? Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. In effect, they rejoice because prices have risen for the “hamburgers” they will soon be buying. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.”…

“So smile when you read a headline that says “Investors lose as market falls.” Edit it in your mind to “Disinvestors lose as market falls — but investors gain.” Though writers often forget this truism, there is a buyer for every seller and what hurts one necessarily helps the other. (As they say in golf matches: “Every putt makes someone happy.”)”

As of September 1, year to date the S&P Index is up 13%. This is after, seeing the market decline 39% in 2008. So why are investors happier today than in 2008? It’s because we often confuse the term investing with gambling. Gamblers, or those who were in stocks with a timeline of less than 5 years, were the ones negatively affected by the decline. Investors or those who buy and hold for long periods of time made out great.

As a young investor, your time to be a “net saver” is decades. Therefore, next time the stock market declines, be happy for positive news.

Comments on this entry are closed.